San Francisco Chronicle/Hearst Newspapers via Getty Images

- Goldman raised the prospect of stronger-than-expected spending pushing core PCE inflation to 2.5% by year-end.

- This would “increase the odds” of the Fed cutting back on bond-buying sooner than expected.

- Yet, Goldman thinks it is most likely that inflation will hover below 2% and that the Fed will taper in 2022.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Goldman Sachs has raised the prospect of a bigger-than-expected boom in consumer spending lifting inflation to 2.5% by the end of the year, which it said would “increase the odds” of the Fed cutting back its support for the economy sooner than anticipated.

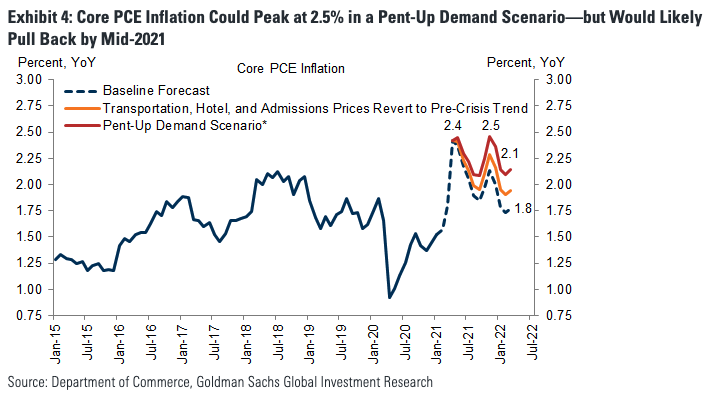

However, Goldman thinks core PCE inflation will most likely peak at 2.4% in April before dipping to 2% by the end of the year, analysts led by Spencer Hill said in a note on Tuesday. The bank’s central forecast is for the Fed to start tapering bond purchases in early 2022.

Yet, Goldman raised the possibility of “an even more dramatic surge in demand” than previously expected, if people who have been able to save during the pandemic rush out to spend their money, causing a “boom in travel and recreation.”

In such a scenario, the analysts predicted that core personal consumption expenditures inflation would stay above 2% from April and rise as high as 2.5% in the final quarter of the year. Year-on-year core PCE inflation stood at 1.5% in January, while consumer price index inflation was 1.4%.

The analysts said this – along with an expected drop in unemployment to 4.5% – “would increase the odds of [the Fed] tapering asset purchases in late 2021, a bit earlier than we expect.”

Goldman Sachs

Such a prospect would be worrying for stock markets, which have boomed since March last year, thanks in large part to the Fed pumping money into the economy through its massive bond-buying programme.

A sharp sell-off in stocks last week demonstrated that investors are nervous about the rapid rally in equities, and feel rising inflation and bond yields could dent stock valuations.

Yet, Goldman Sachs think it is most likely that inflation will hit 2.4% in April before dropping relatively quickly to below 2% by the start of 2022. Its baseline forecast is for the Fed to start cutting back on bond purchases gradually from the start of 2022.

It said the predicted spike in April is largely because of "baseline effects" - that is, because inflation in April 2020, which April 202 1's figure will be measured against, was low.

Fed chair, Jerome Powell, has said the central bank will keep supporting the economy until "substantial progress" has been made on inflation and unemployment, which he has said is "likely to take some time."